Out of a 164-year history, Wells Fargo is neck deep in the biggest scandal the bank has ever faced. Illegal bank accounts and credit card accounts were opened, thousands of employees were fired, and the threat of class action lawsuits are looming. Is there anything Wells Fargo can do to atone for this incredible breach of trust? The new CEO seems to be open to ideas.

Out of a 164-year history, Wells Fargo is neck deep in the biggest scandal the bank has ever faced. Illegal bank accounts and credit card accounts were opened, thousands of employees were fired, and the threat of class action lawsuits are looming. Is there anything Wells Fargo can do to atone for this incredible breach of trust? The new CEO seems to be open to ideas.

Are Wells Fargo Employees Going to Get More Than an Apology?

The Wells Fargo ghost account scandal involves approximately 2 million bank and credit card accounts that were opened without customer approval. This dishonest action, which borders upon fraud, shocked the public and started calls for retribution. So far, around 5,300 employees have been fired for their part in the scandal, but many of these employees are low level workers. Many executives and managers escaped retribution, and the public and Congress weren’t satisfied.

After appearing before congress twice, John Stumpf was forced to step down as CEO of Wells Fargo. He was also forced to give up $41 million in stock awards. However, Stumpf’s departure and the $185 million fine levied against the bank does little to make up for what happened, and Stumpf’s replacement seems to get that.

Tim Sloan stepped up into the CEO position at Wells Fargo, and as one of his first acts as CEO, he addressed all the bank’s employees. He apologized to bank staff, to the lower-level employees who Stumpf appeared to blame, and to the people caught up in their poor sales practices. Many employees felt pressured to meet unrealistic sales goals, and so they opened fake accounts to keep their jobs. Others tried to point out what was going on, but they were either punished or fired for speaking out. Sloan said the reports of retaliation were disturbing, then he promised to restore trust in Wells Fargo.

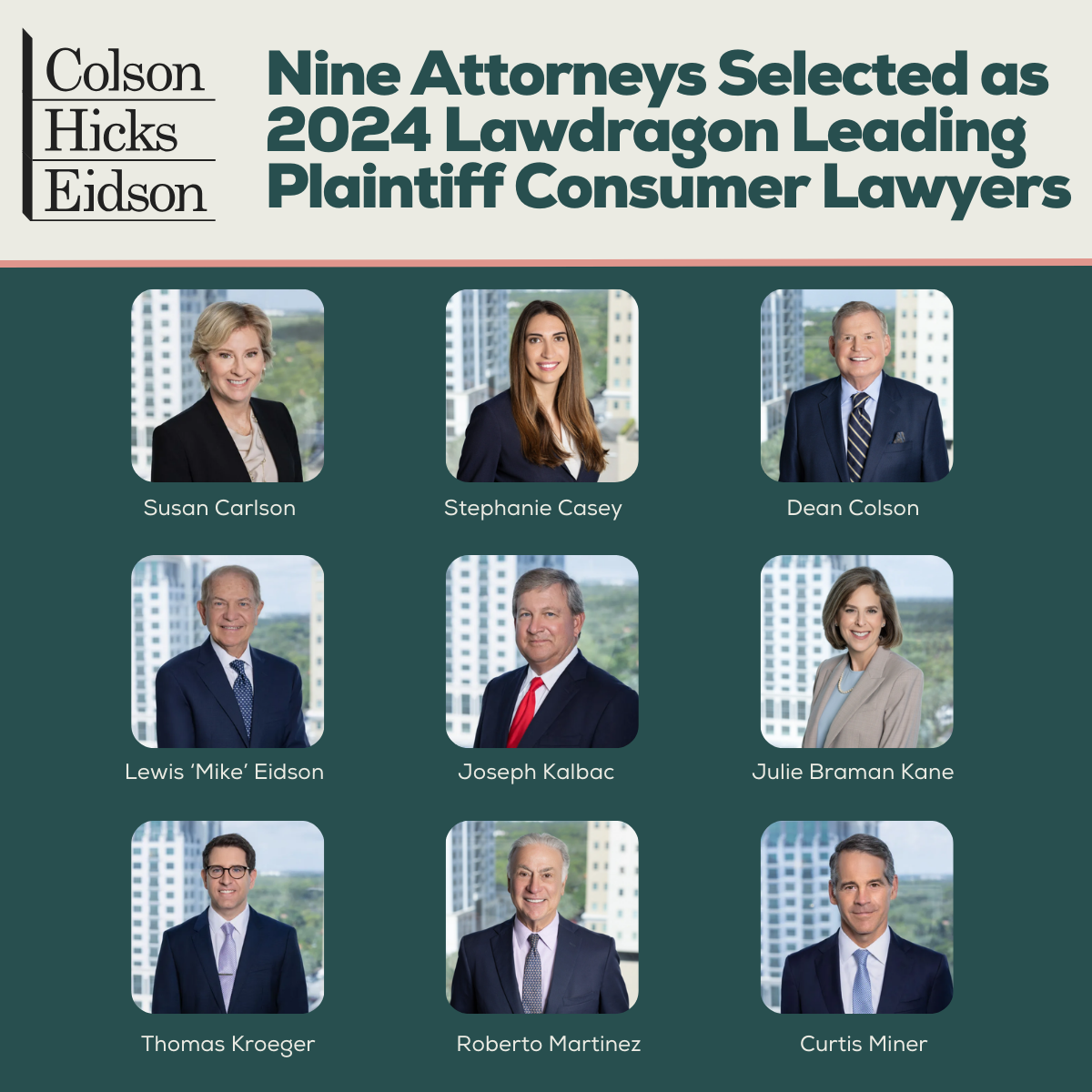

Do you think Sloan can repair the damage to Wells Fargo’s reputation? Do you think employees deserve more than an apology? What do you think the new CEO can do to live up to his word? Share your thoughts on Twitter and Facebook, and keep following our blog. The Miami personal injury attorneys here at Colson Hicks Eidson want to stay on top of future developments and keep you informed of your legal rights.